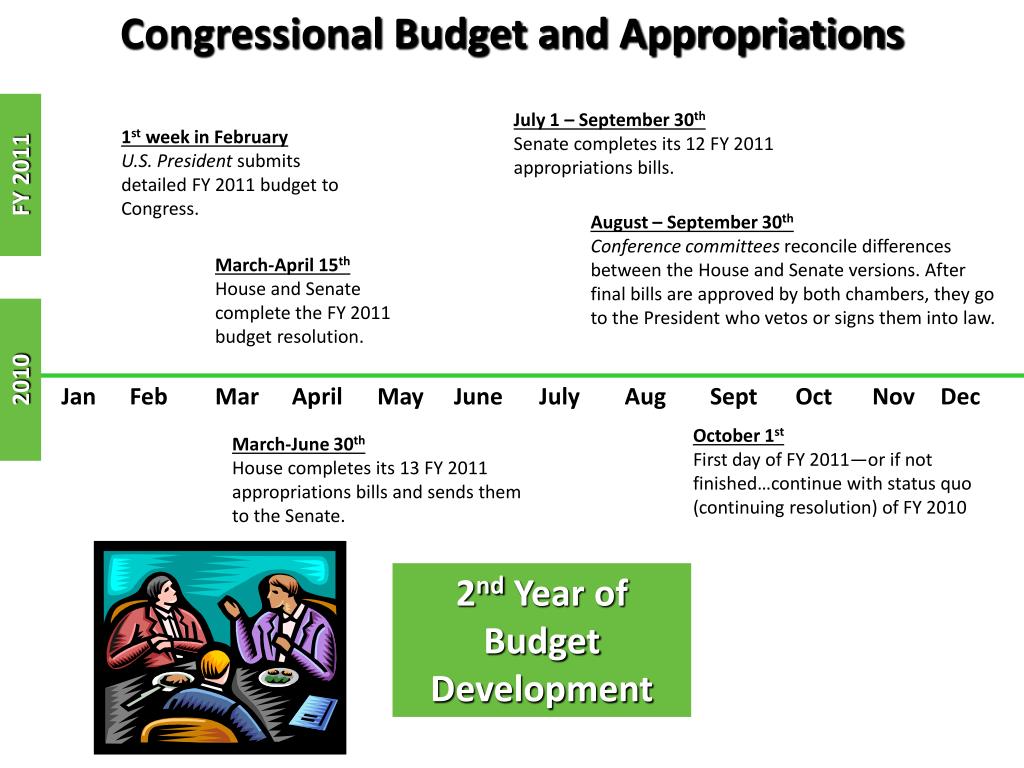

Maintains funding based on the current rate to prevent a lapse in spending. Continuing resolution (only if necessary) Congress has not completed this work on time since 1997. Twelve measures funding federal agencies and programs. There is no penalty for being late, or even for declining to adopt a budget resolution, and no role for the president. Sets revenue and spending targets for legislation. This offers a preview of the major spending and policy debates. Congressional hearings (February – spring)Īgency officials testify before authorizing and appropriating committees in order to justify budget requests. For example, President Joe Biden released his first budget request on May 28, 2021, and the request for FY2023 on March 28, 2022. The president’s budget request timing is typically delayed in a new administration. The law requires submission, but there is no penalty for being late. President’s budget request (first Monday in February)Ī detailed request for each department and agency. These details make reconciliation bills an attractive target for policy changes that have a budgetary effect (such as health care programs).ġ. Proponents also only need a simple majority rather than the 60-vote supermajority that applies to most legislation under the chamber’s cloture rules – if everyone shows up, that means 51 votes. In the Senate, debate is limited to 20 hours, meaning the measures can’t be filibustered. If a single committee receives instructions (for example, just the House Ways and Means Committee on a revenue measure), its recommendation can be sent directly for a floor vote. If more than one committee receives instructions, then the individual committees first send their recommendations to the House and Senate Budget committees, which consolidate the proposals. The reconciliation instructions also can require reporting of debt-ceiling legislation, which can come in handy because of the simple majority factor. How the budget reconciliation process worksīudget resolutions can include instructions to committees to report reconciliation legislation, often with a deadline, to meet spending and revenue targets. It allows lawmakers to advance spending and tax policies through the Senate with a simple majority. The reconciliation process was created by the Congressional Budget Act of 1974. Some tax laws are permanent, while others have expiration dates that cause Congress to revisit tax rates, credits, and other rules. Revenue measuresĬongress doesn’t have to act each year on a measure raising revenue. Most authorizations require congressional appropriations action and are referred to as discretionary. Some authorization bills provide funding for one or more years without further action, known as a mandatory program. 1, the start of a fiscal year, a continuing resolution can be used to extend funding for a period of time, typically at the previous year’s level.Īuthorization measures are used to create departments, agencies, and programs set rules for how they’re operated and set funding levels. If a full-year appropriation isn’t in place by Oct. Each subcommittee comes up with a bill that must pass both chambers and be signed by the president to take effect. The House and Senate appropriations committees are divided into 12 subcommittees, which hold hearings to discuss budget requests and needs. What occurs during the appropriations process Appropriations billsįederal agencies receive funding for a fiscal year through appropriations bills passed by Congress based on the president’s recommendations and congressional priorities. And in FY 2017, the resolution was adopted in January, four months into the fiscal year. The House didn’t adopt a budget resolution for fiscal year 2011. The Senate didn’t adopt budget resolutions for fiscal years 2011 through 2013, as well as FY 2023.

#Congressional budget office definition series#

Lawmakers have often skipped this step in recent years, instead working out a series of two-year deals that increased spending caps that had been set by law. The resolution is without force of law, and it doesn’t go to the president. The budget resolution is a blueprint that takes a holistic approach to spending, revenue, and the resulting deficit or surplus to govern internal decision-making. It outlines estimates for revenue and expenditures and details the administration’s policy and spending priorities. Early each year, the White House proposes the level of spending for federal agencies and programs.

0 kommentar(er)

0 kommentar(er)